|

The Sunday Telegraph: Cairn's desert storm:

The oil minnow bought the rights to drill in the

Rajasthan wilderness from Shell for a paltry £4m. Its

hunch paid off spectacularly and Cairn is now a FTSE100

company.: "Since that time, its market capitalisation

has more than quadrupled to over £3bn today.": "At an

oil price of around $50 per barrel, that production will

translate into $2bn worth of net cashflow for Cairn."

Sunday 20 November 2005

(Filed:

20/11/2005)

The oil minnow bought the rights to

drill in the Rajasthan wilderness from Shell for a

paltry £4m. Its hunch paid off spectacularly and Cairn

is now a FTSE100 company. Sylvia Pfeifer travelled to

India to see the oilfields and talked to the people

responsible for getting them onstream

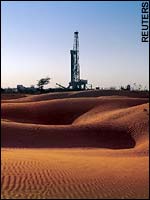

A group of men in bright orange

overalls stands sweating in the baking heat of the

Rajasthan desert. A 70 ft triangular drilling rig towers

above them, the only feature in an otherwise empty

skyline. Hundreds of metres below them, the drill they

are tending is boring its way towards what they hope

will be another oil discovery for Cairn Energy. By

tomorrow, they will know whether they have hit the

jackpot.

| |

|

| A Cairn drilling

rig in the Rajasthan desert |

If successful, it will be Cairn's

latest discovery in the wilderness of the Rajasthan

desert. Some 16km to the east of the "NI North" prospect

lies Mangala, the largest oil find in India for 22

years. The discovery of Mangala - which means "Goddess

of Power" - in January 2004 changed Cairn almost

overnight from an Edinburgh-based oil and gas explorer

into a FTSE100 company. Since that time, its market

capitalisation has more than quadrupled to over £3bn

today.

For India, Mangala - and the 1bn

barrels of oil it contains - has been just as, if not

more, significant. Consistently ignored by the world's

oil giants, the discovery has sparked renewed interest

in the country as a viable and lucrative oil and gas

province. With Cairn as its poster boy, India's latest

bidding round for exploration licences attracted

interest from a record number of international majors,

including BP and Italy's ENI.

"The country is highly underexplored,"

says V K Sibal, the director general of India's

directorate general of hydrocarbons. To date, just seven

of the country's 26 hydrocarbon-bearing basins have been

explored and Sibal's aim is to evaluate all of them by

2025.

It is an ambitious target but India

desperately needs to find more buried treasures like

Mangala. With the economy set to grow between 7 per cent

and 8 per cent, the country's demand for oil and gas is

forecast to double by 2020. It currently imports around

70 per cent of the oil it needs and with crude prices at

record levels, India is spending an estimated $25bn a

year on securing supplies.

For Sibal, the key to achieving his

goal is to increase the number of operators exploring in

India and bring in people with the right kind of

knowledge.

"I believe in the knowledge of

people and I want to get the knowledge by diversifying

more," he says. "What we need is the people - people who

are passionate about exploration."

It is a passion that he clearly sees

in the team at Cairn. Unlike other independent explorers

who normally spread their risk by taking minority stakes

in fields around the world, Cairn has always made a

point of taking 100 per cent positions in areas where

little or no gas and oil has been found.

The two men behind this high-risk,

high-reward approach are Bill Gammell, Cairn's chief

executive, and Mike "Sniffer" Watts, the exploration

director who is widely credited with spotting the right

opportunities. Together since 1995, the two have forged

a close relationship that thrives on friendly

competition which extends to seeing who can be first out

of an aeroplane.

"When it comes to Bill and Mike,

it's a case of one and one makes three," says a Cairn

executive. "Together, they probably have more ideas than

they would alone."

According to Gammell, Cairn's

strategy has always been to create value "by being an

initiator and a pioneer". He is a fervent believer in

the management concept that 20 per cent of your

activities will account for 80 per cent of your results.

Hence his and Watt's decision a

decade ago to shed assets in the US and the North Sea

and instead put all their efforts into India and

Bangladesh. The pair had noticed that the oil majors had

overlooked the region, drilling some 8,000 wells around

South and South East Asia but just 12 on the

Subcontinent.

Cairn's relationship with Rajasthan

dates back to 1997 when it bought out Shell in

Bangladesh and acquired a stake in the Rajasthan field

as part of the same deal. Famously, Cairn bought Shell's

50 per cent share in the block for a mere $7.25m (£4m)

three years ago. Since then, Cairn has drilled 100 wells

- compared with just three wells that were drilled while

Shell operated the block. It was Watts, who never tires

from pulling out a map showing Cairn's acreage in

Rajasthan, who got the early morning call last January

that Cairn had hit the jackpot.

The message was crystal clear: "This

is the real deal, Mike." He rang Gammell and the rest,

as they say, is history.

Cairn's aggressive strategy has

certainly paid off in Rajasthan. The scale of its

acreage is immense: it is equivalent to 30 North Sea

blocks and the company has so far built 300km of road

through a desert wilderness that is dotted with hamlets

of thatched huts where locals live and an array of

wildlife, including camels, monkey and deer. Indian

mobile phone companies have since extended their

coverage to this remote region.

By betting big on India and

Bangladesh, the company has also built up invaluable

contacts and goodwill with the local, state and national

politicians. Subir Raha, the executive chairman of

India's biggest company, Oil and Natural Gas Corp

(ONGC), is another high-level contact, in part because

his company has a 30 per cent stake in the Rajasthan

oilfields.

"The key element about doing

business in India is alignment," says Gammell,

As a result an increasing emphasis

is being placed on hiring local workers. According to

Santosh Chandra, who heads Cairn's operations in the

Cambay Basin in Gujarat, the reason the company has

managed to maintain good relations in India is because

"Cairn are seen as the guys who are really here for the

long haul. They have re-invested every dollar they have

made.".

Nevertheless, Cairn's exploration

success is bringing with it a whole new set of

challenges.

It has so far invested between $300m

and $400m in Rajasthan and it will cost Cairn and its

partner, ONGC, around $750m to bring Mangala into

production as well as build a processing plant and power

station. The field is expected to produce between

100,000 and 110,000 barrels a day by the time it is

scheduled to come onstream in early 2008.

For all this to happen on time,

Cairn and ONGC need to approve a field development plan

by the end of this year. Key will be getting ONGC's

sign-off on the plan, as well as some assurance from

ONGC that it will build a pipeline to carry the crude

oil from Mangala to the coast.

Raha says the pipeline is a priority

for ONGC, not least because the company, which is still

majority-owned by the government, plans to increase its

own production from 1.1m barrels per day of oil and gas

equivalent to more than 1.5m barrels per day by 2011.

Keeping the locals onside will also

be crucial as the company's operations expand. Cairn has

so far invested money in upgrading local infrastructure

and supplying pumps and equipment to improve rural water

supply.

Meanwhile for Cairn itself, a

priority will also be to make sure that the

entrepreneurial spirit that has defined the company

until now does not get lost as it gets bigger and

becomes a large-scale producer.

A possible turning point will come

in three to four years' time, once Cairn's production

hits 150,000 barrels per day. At an oil price of around

$50 per barrel, that production will translate into $2bn

worth of net cashflow for Cairn.

What it will do with that sort of

money is a question that is already being pondered by

Gammell. All options are still open but Gammell says one

possibility could be a "mega-special dividend". Another

would be to split the company into two separately listed

companies, an exploration and a production stock.

He cautions, however, that for now,

the focus is firmly on realising the value of Cairn's

discoveries, as well as continuing to explore in other

areas. The company has quietly built up a position in

Nepal in recent years, a region that Watts believes

could well turn into another lucrative oil and gas

province.

Watts' enthusiasm for exploration

not withstanding, there is one potential prospect in

Cairn's acreage that may well have to remain out of

bounds: underneath the Utarlai military airfield, just

55m from the border of Pakistan. |